Morocco has solidified its position as a prime destination for foreign capital, recording in 2024 its second-best performance in foreign direct investment (FDI). The year 2025 has also started on a strong note, with a record month for capital inflows. During a session at CGEM on Tuesday, March 11, Karim Zidane, Minister Delegate for Investment, Convergence, and Policy Evaluation, presented a detailed assessment of the efforts undertaken to boost investment in the Kingdom.

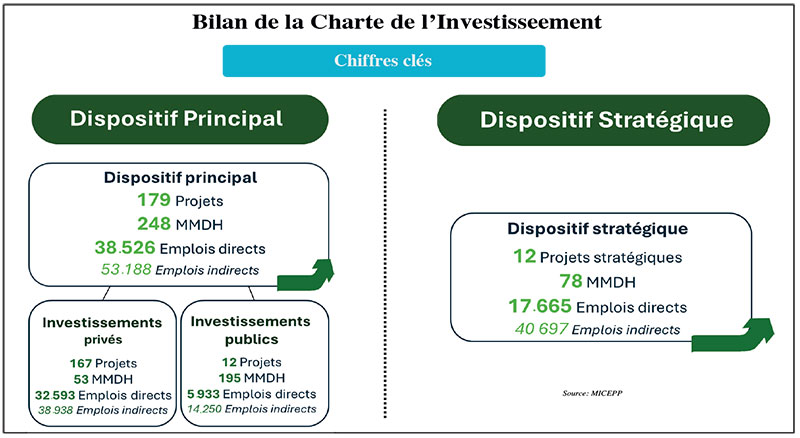

To maximize the country’s potential, the minister stressed the need to overcome structural challenges while capitalizing on reforms implemented in recent years. The key drivers identified include a renewed strategic framework, continuous reforms of the legal and regulatory framework, and enhanced competitiveness on the international stage.Job creation remains at the core of the government’s investment strategy. Two years after the adoption of the Investment Charter, the initial results appear promising. Between 2022 and 2024, the National Investment Commission (CNI) approved 191 projects, representing a total investment volume of 326 billion dirhams and announcing the creation of 150,000 direct and indirect jobs. According to Zidane, nearly 83% of the approved projects have already been launched, demonstrating that investor commitments go beyond mere promises and are translating into concrete actions. The main investment framework, comprising 179 projects, has generated 248 billion dirhams in investments and over 90,000 jobs. Among these, 167 projects are driven by private companies, both Moroccan and foreign, totaling 53 billion dirhams and creating 70,000 jobs. Strategic initiatives highlight Morocco’s commitment to economic diversification and investment in high-growth sectors. Twelve major projects have been approved, representing 118 billion dirhams, with a particular focus on electric vehicle value chains and gigafactories. One of the key objectives of the Investment Charter was to rebalance the geographic distribution of investments. Nearly 50% of approved projects have been established outside the traditional Tanger-Casablanca-El Jadida axis, demonstrating concrete efforts to reduce regional disparities and promote more equitable growth across the country. The sectoral diversity of investments is another strength. The 191 approved projects span 33 economic sectors, including agro-food, automotive, textiles, construction materials, services, tourism, and new technologies. This inclusive approach reflects Morocco’s ambition to diversify its economy and strengthen its industrial competitiveness. Beyond these achievements, Morocco’s greatest challenge lies in sustaining this momentum over the long term. The next steps must focus on further diversifying investments, particularly in innovative and future-oriented sectors. Reforms must continue to be reinforced to ensure Morocco’s global competitiveness while maintaining regional and sectoral balance.

Khadija MASMOUDI