Economic operators are currently questioning the post-dismantling landscape of the quasi-monopoly held by the Interbank Electronic Payment Center (CMI) in electronic payments. This dismantling was ordered by the Competition Council on November 4. Since that date, the CMI is no longer allowed to accept new clients but must continue managing its existing portfolio until the official transition. However, it can still onboard specific merchants for technical reasons, such as a new store opening under a large commercial chain that is already a client.

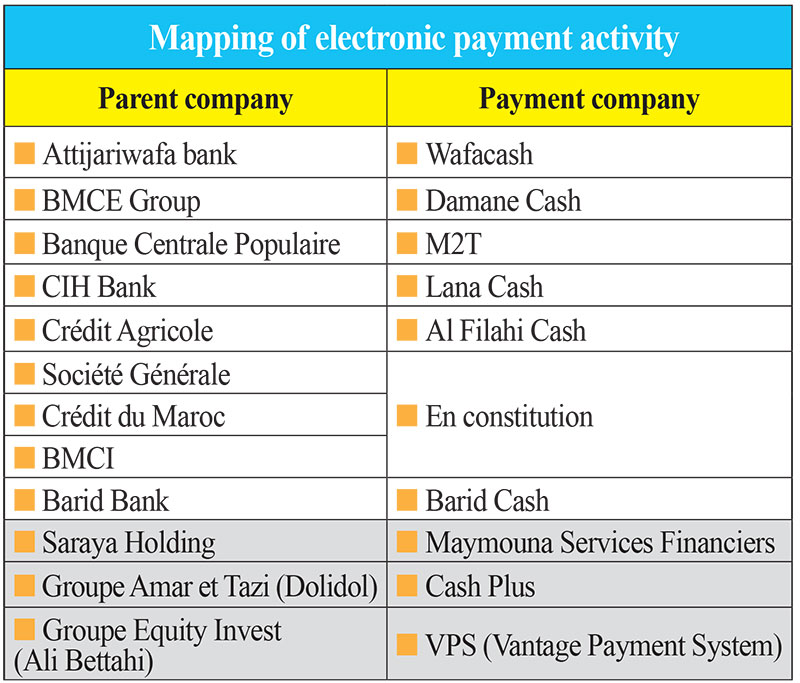

During this monopoly breakdown, existing clients may either renegotiate their contract terms or switch to one of the two currently operational payment institutions. Before the CMI’s establishment in 2004, following a Board of Directors meeting of the Moroccan Banking Association (GPBM), electronic payment solutions were exclusively managed by banks. At that time, no specialized payment companies existed. GPBM had appointed two investment banks to evaluate the contracts before their transfer and determine their sale price. Only after this assessment did banks transfer their client portfolios to CMI. Now, CMI must undergo the same process, appointing one or two independent investment banks to assess the value and sale price of its client portfolios based on transaction volumes and commissions. This process will also define a distribution key according to the shareholding structure of CMI. Ultimately, the appointed investment banks will determine the total market value of these contracts per bank. This is a major business opportunity involving more than 55,000 contracts and approximately 65,000 point-of-sale (POS) terminals. Once evaluated, these portfolios will be transferred to shareholder banks for a fee. Subsequently, these banks will resell the contracts to their specialized subsidiaries, such as Wafa Cash, M2T, Damane Cash, Lana Cash, and Filahi Cash. Other payment companies may also enter the market, including Cash Plus, Maymouna Financial Services, and VPS (Vantage Payment Systems). Additionally, subsidiaries of the three telecom operators-Maroc Telecom, Inwi, and Orange-are expected to compete in this space. Most of the main shareholder banks of CMI already own their own payment institutions, with the exception of BMCI, Société Générale, and Crédit du Maroc. However, these banks are expected to establish their own subsidiaries soon (See payment companies map).

Hassan EL ARIF